Introduction to Bookkeeping

Bookkeeping SOLUTIONS

Big Bird Bookkeeping Solutions offers expert bookkeeping services, including virtual bookkeeping with QuickBooks Online, to ensure your business’s finances are accurately managed. Professional Bookkeeper Julia provides support and maintains up-to-date records, helping your business thrive.

Big Bird Bookkeeping Solutions saves you time by:

- Managing daily cash flow & expense tracking

- CRA compliance so that you can focus on growth.

QuickBooks Online powers automation that:

- streamlines your bookkeeping and accounting workflows, and

- ensures accuracy and efficiency in every detail.

From Payroll Processing to in-depth financial analysis, Big Bird Bookkeeping Solutions is here to provide essential support and value to your business.

Reach out today to learn how we can simplify your financial operations and give you back precious time.

Professional Bookkeeping

Why Hire a BOOKKEEPER?

Hiring a professional bookkeeper offers multiple benefits to small and medium-sized businesses. They maintain accurate financial records, which are essential for informed decision-making and strategic planning. By handling routine financial tasks, bookkeepers free up time for owners to focus on core business activities. They can identify cost-saving opportunities and enhance cash flow management, contributing to improved financial health. Ensuring compliance with tax laws and regulations, they help avoid costly penalties and legal issues. Additionally, organized financial records facilitate smoother audits and increase transparency for investors and lenders. Ultimately, a skilled bookkeeper supports financial stability and promotes business growth.

Bookkeeping Services

How it WORKS

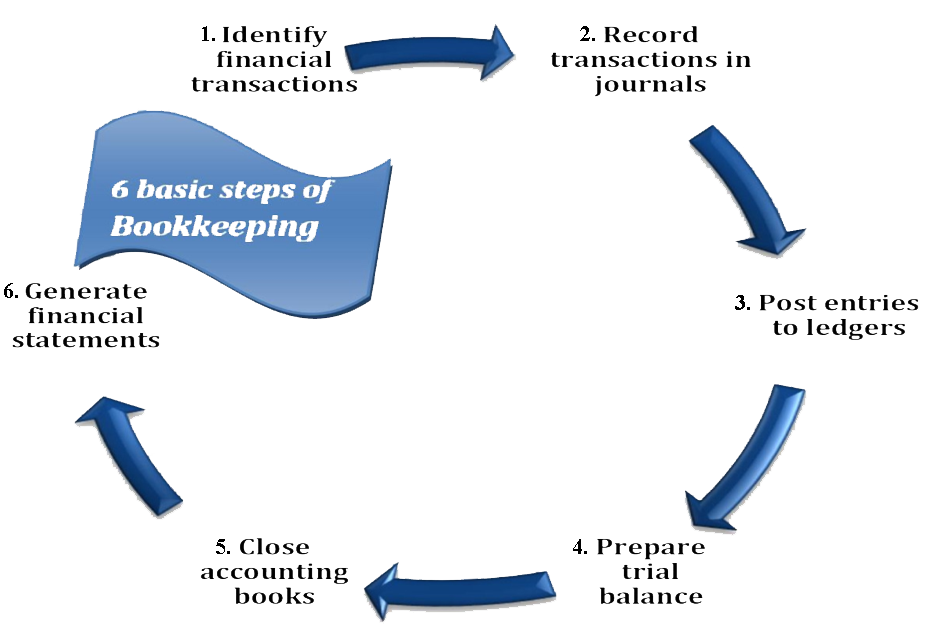

The 6 Basic STEPS of BOOKKEEPING

1. Identify financial transactions

Gather all financial activities—sales, purchases, payments, and receipts—by collecting invoices, bank statements, and other financial documents to ensure complete and accurate records.

2. Record transactions in journals

Record each transaction in journals with details like date, description, amounts, and affected accounts, using the double-entry accounting system to maintain balanced accounts.

3. Post entries to ledgers

Transfer journal entries to the general ledger, organizing them into specific accounts (e.g., cash, sales, expenses) to track financial activity over time and provide a clear financial picture.

6. Generate financial statements

Use the updated ledger to create key financial statements including the Income Statement, Balance Sheet, and Cash Flow Statement.

5. Close accounting books

Reset balances of temporary accounts (revenues, expenses) by transferring them to permanent accounts (retained earnings), and preparing the accounts for the next period.

4. Prepare trial balance

At the end of the accounting period, prepare a trial balance by listing all ledger accounts and their balances to verify that total debits equal total credits and identify any discrepancies before finalizing accounts.

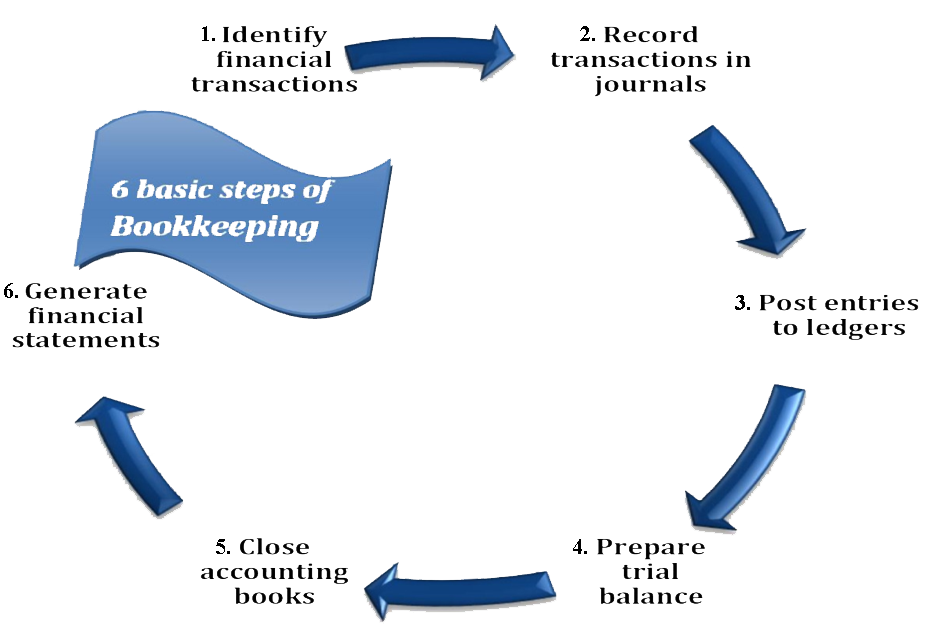

The 6 Basic STEPS of BOOKKEEPING

1. Identify financial transactions

Gather all financial activities—sales, purchases, payments, and receipts—by collecting invoices, bank statements, and other financial documents to ensure complete and accurate records.

2. Record transactions in journals

Record each transaction in journals with details like date, description, amounts, and affected accounts, using the double-entry accounting system to maintain balanced accounts.

3. Post entries to ledgers

Transfer journal entries to the general ledger, organizing them into specific accounts (e.g., cash, sales, expenses) to track financial activity over time and provide a clear financial picture.

4. Prepare trial balance

At the end of the accounting period, prepare a trial balance by listing all ledger accounts and their balances to verify that total debits equal total credits and identify any discrepancies before finalizing accounts.

5. Close accounting books

Reset balances of temporary accounts (revenues, expenses) by transferring them to permanent accounts (retained earnings), and preparing the accounts for the next period.

6. Generate financial statements

Use the updated ledger to create key financial statements including the Income Statement, Balance Sheet, and Cash Flow Statement.

Discovered a New or Unfamiliar Bookkeeping Term?

Check Out Our…

Bookkeeping Glossary!

Professional Bookkeeper

Bookkeeping Services

At Big Bird Bookkeeping Solutions, we offer a comprehensive range of services designed to streamline your business’s financial management.

From day-to-day account management and maintaining up-to-date records to GST reporting, annual and monthly financial reporting, and cash flow forecasting, Julia, a Professional Bookkeeper, ensures precision and compliance. We handle accounts payable and receivable, process payroll, manage bank feeds, and provide virtual bookkeeping with QuickBooks Online. Additionally, we prepare financial statements, perform balance sheet reconciliations, set up business software, and offer consultation and training. Whether you need a complete catch-up and clean-up or ongoing support, Big Bird Bookkeeping Solutions is dedicated to keeping your finances organized and your business thriving.

Professional Bookkeeper

Bookkeeping Services

At Big Bird Bookkeeping Solutions, we offer a comprehensive range of services designed to streamline your business’s financial management. From day-to-day account management and maintaining up-to-date records to GST reporting, annual and monthly financial reporting, and cash flow forecasting, Julia, a Professional Bookkeeper, ensures precision and compliance. We handle accounts payable and receivable, process payroll, manage bank feeds, and provide virtual bookkeeping with QuickBooks Online. Additionally, we prepare financial statements, perform balance sheet reconciliations, set up business software, and offer consultation and training. Whether you need a complete catch-up and clean-up or ongoing support, Big Bird Bookkeeping Solutions is dedicated to keeping your finances organized and your business thriving.

Bookkeeping Services

Contact Julia Today For a FREE Consultation

Call (250) 731-2193

Or Fill Out The Contact Form